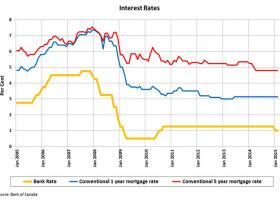

Growth outlook for 2016 lowered by Bank of Canada as rates are kept on hold.

The Bank of Canada announced on January 20th, 2016 that it was keeping its trend-setting target overnight lending rate at 0.5 per cent.

The Bank cited divergence as a key theme in its most recent announcement. Globally, a steady and on track recovery in the U.S. coupled with higher economic growth in oil-importing emerging markets is expected to more than offset the ongoing deceleration in Chinese growth.

In Canada, 2016 is forecast to be another bad year for energy-producing provinces, masking improving fortunes elsewhere in the country. As such, the forecast for Canadian economic growth in 2016 has been lowered from two per cent in the October 2015 Monetary Policy Report (MPR) to just 1.4 per cent in the Bank’s most recent MPR.

That said, the Bank cites a key upside risk to this forecast, namely the decision not to incorporate any fiscal measures until they are announced. That means the forecast could be raised in the future, possibly as early as April when the next MPR is published. It will depend on the date of the new government’s first federal budget, which will likely lay out much of the promised stimulus spending not yet factored into the Bank’s forecast.

The main downside risks to the forecast are oil and other commodity prices. If oil prices fall further or remain low longer than expected, the Bank is concerned about “threshold effects”. The worry is that a large number of firms that have been able to make adjustments and stay afloat thus far may buckle as low prices eat further into their balance sheets. For other commodity prices, the concern is that demand from emerging markets will be weaker than expected.

The disinflationary gap between actual and potential economic growth in Canada, known as slack, continues to grow. While this trend is expected to reverse itself this year, it is not expected to close until late 2017 – later than previously thought.

On inflation, the story remains the same. Overall inflation is still running near the bottom of the Bank’s 1 to 3 per cent target range as the effects of economic slack coupled with lower consumer energy prices more than offset the inflationary effects of the lower Canadian dollar.

That same trend is expected to play out again in 2016, as the Bank expects a return to a more typical relationship between the price of oil and the price of gasoline (i.e. cheaper gas). That said, while consumers will likely be paying even less at the pump this year, expect the price of cauliflower to remain the dominant barometer of inflation around the watercooler.

The risk here is that potential growth is not as great as the Bank’s models currently assume meaning the output gap could be smaller and close sooner. That said, based on current measures of inflation and the output gap, at this point a rate hike in 2016 is off the table.

The bottom line on growth, inflation and interest rates – once again – is lower for longer.

As of January 20th, 2016, the advertised five-year lending rate stood at 4.64 per cent, unchanged from the previous Bank rate announcement on December 2nd, and down 0.15 percentage points from one year ago.

The next interest rate announcement will be on March 9th, 2016, while the next update to the Monetary Policy Report will be on April 13th, 2016.

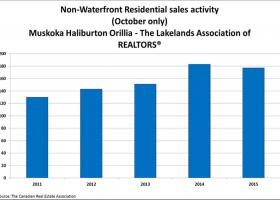

(source CREA)