TO BUY OR NOT TO BUY A COTTAGE IN MUSKOKA

Buying a vacation property is one of the most rewarding things you can do. But it can also be a complex and stressful experience with pitfalls that are different from those you encounter when you buy a house.

9 things you need to know and acknowledge:

1. Why do I want it?

Buying a vacation home isn’t always just about a place to retire or relax. It can also be an investment which generates income when you don’t want to be there. So that’s your first question. Are you using this second home mainly for fun or do you want to rent it out and make some money?

If it is mainly for personal use, then the most important consideration might be the size of kitchen. Is it big enough for family gatherings? Or you might want a big yard for the kids to play, or a massive deck overlooking the lake to barbecue and watch the sun go down. If you are an investor those sorts of detail may be unimportant. Then you might be looking for a smaller property because it is easier to manage and rent.

Figuring out what your priorities are will help you find the right property for you.

2. Keep your emotions in check

Just because you have the cash for a down payment doesn’t mean you should buy the property. Buying a vacation home is bears some risk because as it appeals to the emotions. Before you start on your decision making be sure to thoroughly check your finances. Is your primary home paid off? Can you carry the operating costs? How much can you afford?

Some people take out the equity on their primary home to make a down payment on the vacation home. This certainly works if the housing market remains stable. But if the market falls, so does your equity. It is hard to enjoy your vacation property when your debt may be creeping up on you?

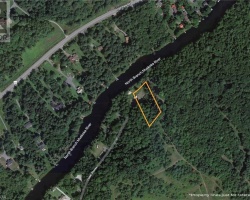

3. Where do I buy?

In Ontario, Muskoka and the Kawarthas have been a traditional rite of summer vacation, within reasonable driving distance of major cities like Toronto, Ottawa and London. Then you should decide on the region as depending on the size of the lake, water clarity, motorised boating allowed or not, topography and other details, this influences the pricing of the properties substantially.

The important thing to think about is the time and the hassle it takes to get there and how often you can actually use it. You’re more likely to head north to cottage country for the weekend than anywhere else in the country or world.

4. Consider pooling resources

One way to ease the burden or to get a nicer property is through joint ownership. Your relatives or friends might want to go in with you. The key is to make sure everyone understands the rules of the road, including a fair way to split up prime time use, what happens when one party wants to sell and who inherits the property. Sitting down and working out who pays what and at what proportion cannot be under estimated. This needs to be discussed BEFORE purchasing together.

5. Location is key

Buy a condo a block away from the beach and your potential rental income could drop by half. Vacationers are willing to pay extra for that week or two they spend in paradise. Views and waterfront are traditionally two of the main features people look for. Consider the trade offs. You may go for a lesser property closer to the waters edge, than a larger property further away.

6. Condo vs house

Do you have a big family and like to be surrounded by friends? Or are your vacations a chance to get away from it all? Thinking about this will help you decide whether you need a small condo, or fully detached home with lots of space.

Make a list of your important features. Things that were important in your family home may not be as important in a vacation property. Do you really need tons of closet space for your two suitcases? Will a galley kitchen do since you plan to be eating out a lot?

On the other hand, maybe you always wanted a pool, or an outdoor shower. Then revisit the amount of time you plan to spend at the vacation property to see whether it’s cost effective.

7. Check out the neighbourhood

Once you’ve decided what to buy and where, stay for a few days and look around. You’d be surprised how many people buy from blueprints only to have a rude awakening later.

You may have vacationed in the area before but not really gotten to know anyone. Talk to neighbors and locals. What do they think of the area and what is it like in the off season? What is there to do in the area? How can you keep busy on rainy days. Is this a good fit for your family?

8. Look for hidden costs

Take a look at taxes, management and condominium fees should you be looking at this type of investment.

Other things to consider:

•Does the condo association/lake community allow rentals? If so under what conditions. Must they be long-term periods of several months or can it be weekly?

•Does the condo association have an adequate reserve fund to pay for future repairs. If not, you could be hit with a special levy once you move in.

9. Cheap doesn’t always mean bargain

Buying on impulse is probably the worst thing you can do. Just because you’re enjoying the sun, atmosphere and special occasion, you still need to step back and consider all the factors. Don’t be blinded by a fire sale price. Do your due diligence.