Why lenders may refuse your mortgage

There are many reasons why a bank may reject your application for a mortgage.

Not enough credit history:

If you are new to the country or you recently finished at college/university or you don’t own any credit cards, lenders likely will not give you a mortgage because of the lack of credit history.

Some people choose to stick only to cash when they transact as they don’t want to risk getting into debt, while others simply have never had the need to enter a credit agreement – such as for a mobile phone or credit card.

The downside to this is that there is no, or limited, established credit history. Any bank you want to borrow money from ideally wants to see if you can manage credit and are in a position to pay it back.

To increase your credit profiling, one option is to take out a credit card. This is a useful way to improve your credit rating so long as you use it – and use it correctly. This means paying off the balance in full every month which will mean you can demonstrate your ability to handle credit and thereby improve your credit score.

Low or bad credit score:

Low or bad credit score:

If your credit score is bad or too low, banks and lenders may not lend you any money. Bad credit ratings result from missed payments in the past, bankruptcy and deferred payments.

If you have had problems repaying a debt in the past, for example on a credit card, personal loan, or even your utility bills, it will show on your credit report and you may find that a mortgage lender refuses your application. This is because the lender will consider you more likely to miss a mortgage repayment or be unable to repay on time.

Recently started a new job:

If you recently started a new job, chances are banks will wait at least until your probation period is over. If you have a stable job and have been working at your current job for some time, lenders will look at you as a better risk.

Too much loan debt:

If you already have too many loans or too much debt (high car payments, student loans), chances are you will be refused for your mortgage.

Self-employed income:

If you are self-employed or you fall under the category of the self-employed contractor, banks and lenders will request the last two years of your income tax notice of assessments.

Too many properties:

Everything is fine if you have a good stable job, you have enough money for a down payment and your credit score is fine. But it is possible the bank you deal with will refuse another mortgage because you now have too many properties.

Unforeseen events in your life:

Life is very unpredictable. Unforeseen events such as health issues, job loss or a divorce will increase the chance that you are going to be refused for a mortgage.

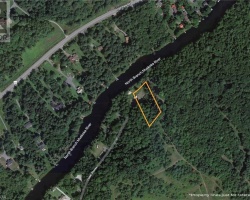

The Property is Less Than Perfect

Sometimes, the problem lies with the home you’re trying to purchase – if there is something less desirable about the property, or it’s overvalued, your lender may refuse to finance your purchase. For example, if you’re looking to buy a condo unit, and the condo corporation’s status certificate indicates past or forecasted financial trouble, your lender may take issue.

Other factors include buying properties with more than four separate units, non-owner occupied purchases with less than a 20% down payment, homes priced over $1 million, and stigmatized homes, such as former marijuana grow-op houses. These property types are not covered by high-ratio mortgage insurers, and you’ll need more than a 20% down payment to qualify for a mortgage for them. Even in that case, there still may be instances where lenders may not feel comfortable and will turn down your application.